In the last weeks, vegetable oil prices have generally been on the rise, with some exceptions. Among others, the most relevant changes that have taken place are:

• the improvement of palm production in Asia

• the pressure on soybean prices at the CBOT (Chicago Board of Trade) due to lower domestic demand in the USA.

• lower import duties on vegetable oils in India.

• slower sales by farmers

• delays in sunflower harvesting

• and a worse rapeseed crop forecast in Canada than the already bearish previous forecast.

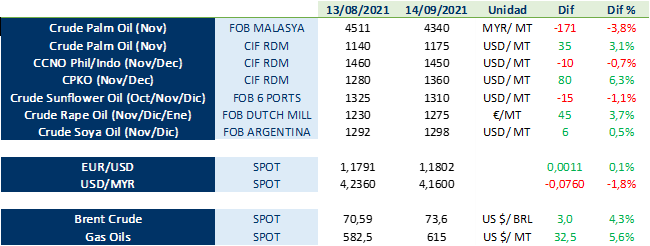

The attached table shows the quotations of the main oils and other reference values and their variation in the last 4 weeks:

Palm oil prices remain historically high because, although the situation is improving, it is still very tight. However, CPO has been losing competitiveness against other oils. The main support for prices came from the reduction of import duties ordered by the Indian government last week and strong export demand.

For rapeseed, the main vegetable oil used for biofuel in Europe, a tense situation is expected throughout this new season. Statistics Canada reduces the Canadian rapeseed production estimate below the 2020/21 and the USDA estimate, which surprised the market. According to their latest report, production will be 12.78 MT (down 13% from August) and 34% below last year. This could lead to a significant volume of European sunflower oil ending this season in use for biofuel to partly offset the deficit and high rapeseed oil prices.

In order to better understand these and other points, we invite you to download and continue reading the LIPSA market report attached below, where you will be able to get first hand information on:

1. Evolution of reference markets

2. Palm oil

3. Lauric oils (coconut and palm kernel)

4. Rapeseed oil

5. Sunflower oil

6. Soybean oil