As usual at this stage of the year, weather will be the key factor for price developments in the coming weeks, as we enter the critical period for sunflower in the Black Sea area, rapeseed in Canada and Australia and soybeans in the United States.

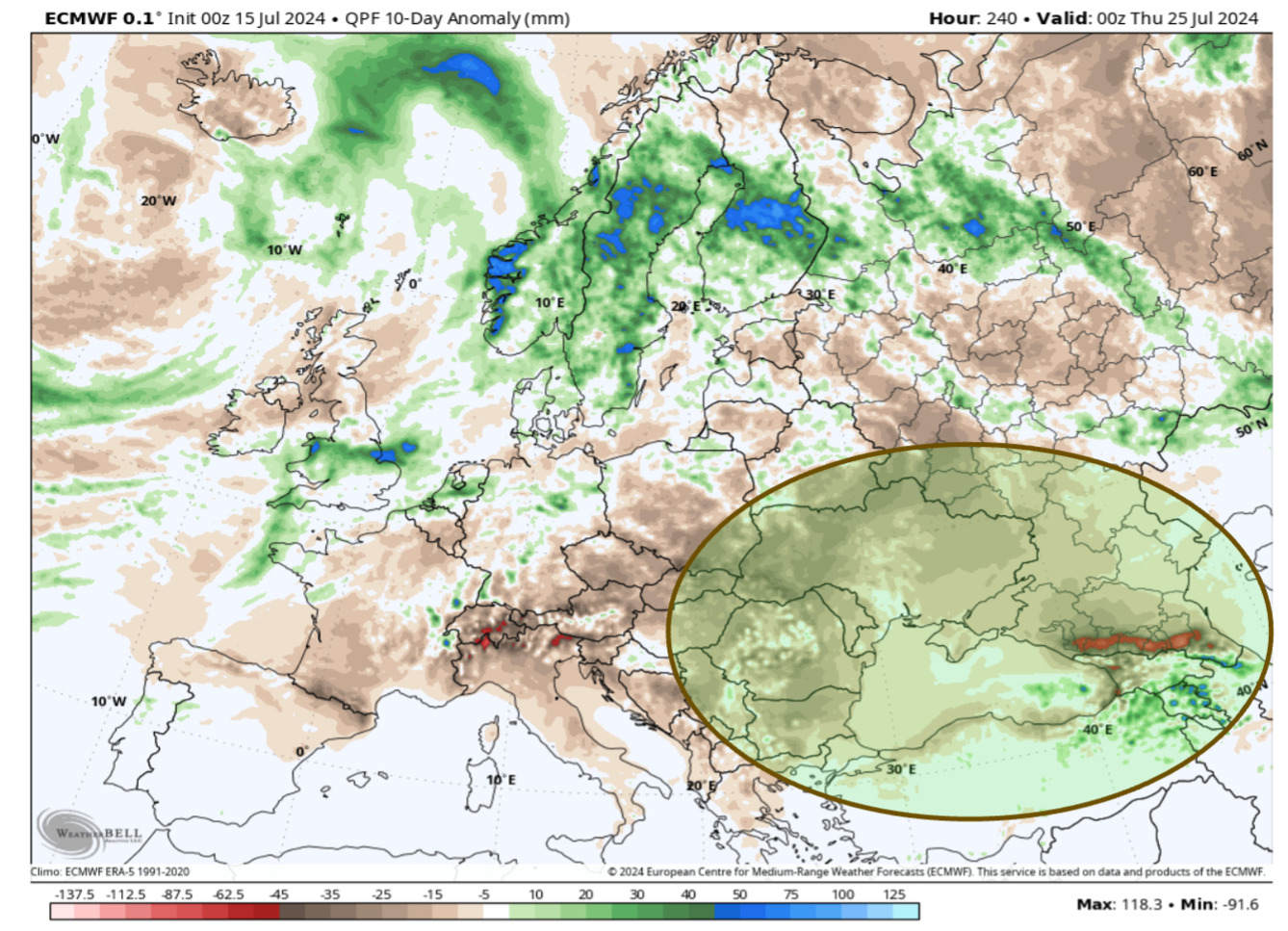

The Black Sea sunflower crop will be lower due to less than ideal weather conditions in recent weeks. Crop yields are at risk and the immediate future weather forecast is not favourable. Even with an optimistic production outlook, global S&D of sunflower seed (and sunflower oil) in 2024/25 is likely to be the tightest in several seasons. Additional production losses would have an upward impact on vegetable oil prices.

The map below shows the rainfall deficit over the last few days:

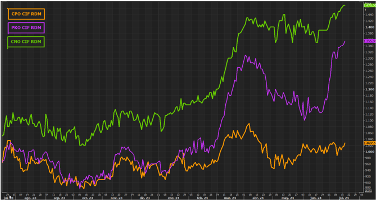

On the other hand, the global supply of rapeseed in 2024/25 will be significantly lower than in previous seasons. As of today, a drop of 4.6 million tonnes of rapeseed is expected. Europe will have to increase its imports due to reduced local supply. Prices on the European market are likely to be higher than at world level.

In the case of soybeans, we expect a significant increase in global crushing, following the recovery of Argentinean production. Global dependence on soybean oil will increase, given the tight supply of rapeseed and sunflower oils and limited growth in palm oil production and exports.

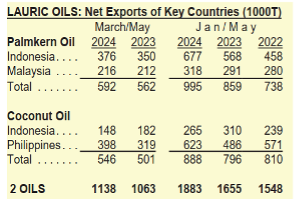

Palm oil has improved its competitive position and is offered at price discounts relative to other oils. A limited supply of sunflower and rapeseed and the expected increase in import demand in several countries should support palm oil prices. As regards the Lauric oils, palm kernel, after maintaining a flat price with a small premium over palm for a long time, attractive prices have boosted volumes so far this year. Exports of palm kernel have increased mainly to the EU-27, Russia, the United States and India (table below with details of the last 3 years’ exports of the main producers, both coconut and palm kernel).

The high level of exports and moderate production growth have reduced the availability of lauric oils in the countries of origin, resulting in the current strong prices.

|

|

|

|---|---|---|

For first-hand information on these and other aspects of the vegetable oil market, we invite you to download and read the LIPSA Market Report by clicking on the button above, where we cover the following points:

1. Rapeseed Oil Market (RSO)

2. Sunflower Oil Market (SFO)

3. Soybean Oil Market (SBO)

4. Palm Oil Market (CPO)

5. Lauric Oils Market (coconut and palm kernel)

6. Conclusions