|

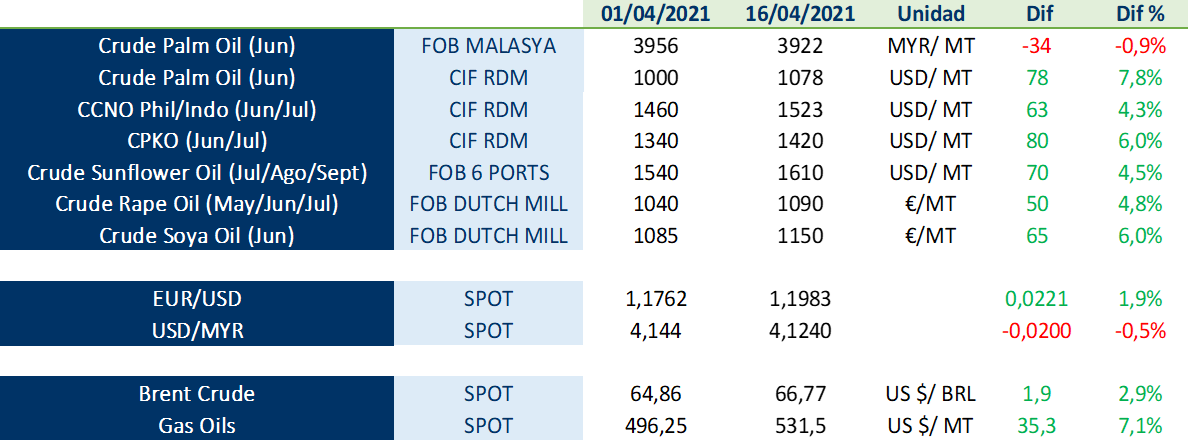

| Palm oil prices remain at historically high levels but the level of competitiveness versus other oils remains strong. The market and analysts continue to expect a correction for Q3-Q4 if Asian production improves and the weather in the northern hemisphere is benign for oilseed production, although this improvement is taking longer than expected a few months ago. In the case of sunflower, OilWorld’s first estimate for Europe speaks of a 5% increase in planted area. With good yields, production would grow by up to 19%. In Ukraine, production could reach a record 16.4 MTs of seeds on the back of a 6% increase in area, according to APK Inform. The soybean and rapeseed oil situation also shows signs of tightness in supply and demand in the short/medium term. In order to better understand these and other points, we invite you to download and continue reading LIPSA’s market report attached below, where you can learn first-hand about the following points:1. Evolution of reference markets 2. Dollar and petrol 3. Palm oil 4. Lauric oils 5. Soybean oil 6. Sunflower and high oleic sunflower oil 7. Rapeseed oil |