Seed oils have been in a downtrend since the beginning of the month and sunflower, in particular, is benefiting from large exports from Ukraine.

Rapeseed oil has good availability. Rising palm prices have made rapeseed prices very competitive for use in biofuels.

Soybean oil is increasingly lower priced because harvests in LATAM, especially in Argentina, have been good and there is very high availability of soybeans.

Palm oil prices have weakened in recent weeks as it has lost competitiveness against other vegetable oils, but it is still the most expensive of the 4 main oils. In parallel, falling stocks in India could lead to a rebound in purchases in the short term. Indeed, in March CPO stocks in India fell to their lowest level since August 2022 (-33% vs. March 23).

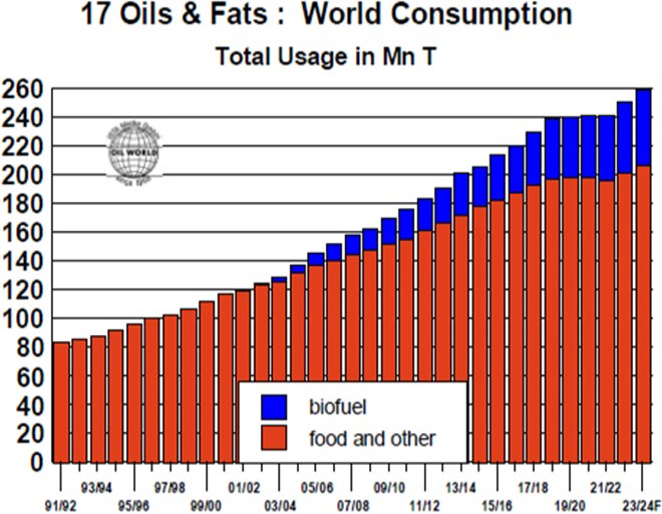

The graph below shows the evolution in the consumption of the 17 main oils at the global level, as well as the relative weight of their use in biofuels, which currently accounts for around 20% of global consumption of oils and fats.

The main non-crop influences affecting the market are:

◘ The demand for biofuels is growing year on year. More and more countries are consuming them by legal mandate and this is a bullish factor for oils.

◘ On the other hand, uncertainties related to the new EUDR (EU Deforestation Regulation) can be seen in the market. It is estimated that the price trend will be upward until the costs derived from the correct traceability of the raw material and other points included in this regulation are clarified.

◘ The instability in the Red Sea area is causing many ships from Asia, mainly carrying coconut, palm and palm kernel oils, to be diverted via Cape New Hope (South Africa). This means longer arrival times for imports to Europe and additional costs.

For first-hand information on these and other aspects of the vegetable oil market, we invite you to download and read the LIPSA Market Report, which you can download by clicking on the button above, in which we discuss the following points:

1. Vegetable oils

2. Demand for vegetable oils

3. Vegetable oil markets

4. Palm oil (CPO)

5. Soybean oil (SBO)

6. Sunflower oil (SFO)

7. Rapeseed oil (RSO)

8. Lauric oils

9. Conclusions