The prices of the main vegetable oils have fallen in recent weeks, most markedly in the case of soybean and rapeseed. In parallel, the euro has continued to appreciate against the dollar, after trading below parity a few weeks ago.

Oil and gas prices have fallen sharply, following the measures put in place by OPEC and certain governments to mitigate the tremendous rises of the last few months.

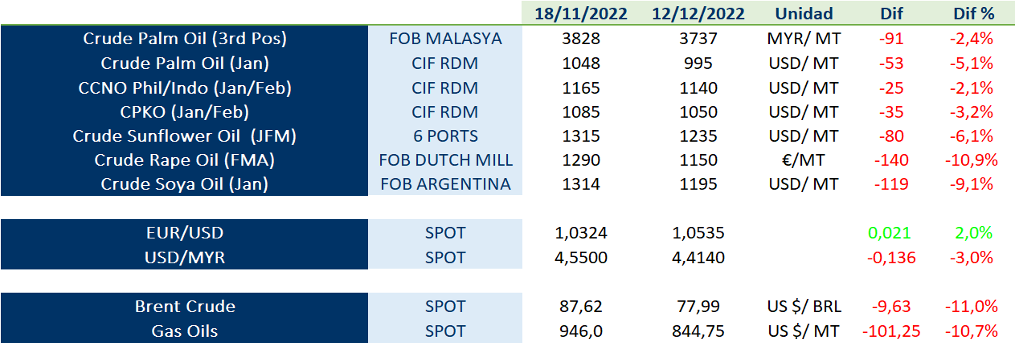

The table below shows the evolution of some oils and other relevant factors in the last month:

At the level of the main oils, the significant drop in soybean prices is due to the fact that the mandate published by the Renewable Fuel Standards (RFS) for the incorporation of this oil in biodiesel in the United States will be lower than expected in the period 2023-2025. In addition, Brazil’s soybean crop forecast is higher than 150 million tonnes, which puts additional downward pressure. The weather in the coming weeks, both in Brazil and in Argentina (which is facing a severe drought) will be decisive for price developments.

As far as sunflower is concerned, exports in the last month have remained very high (more than 400 kton of oil and 385 kton of seed), which puts downward pressure on prices. In general, the European market is well supplied and somewhat calm, following the agreement to extend the duration of the cereal corridor.

Lauric oils, coconut and palm kernel, are at very competitive prices, compared to the last 2 years, with palm kernel slightly more expensive than palm oil and cheaper than seed oils. Coconut production and exports have declined in recent months which puts some pressure on prices:

To learn more about the market situation, we invite you to download and continue reading LIPSA’s market report below, where you will find:

1. Vegetable oil prices

2. Energy

3. Oilseeds

4. Soybean oil

5. Palm oil

6. Sunflower oil

7. Rapeseed oil

8. Lauric oils (coconut and palm kernel)