Vegetable oil prices have taken a breather lately, although fundamentals remain bullish in the short to medium term. In fact, vegetable oil supply and demand for the 2024/25 marketing year looks increasingly tight with an expected production increase of only 2.2 MnT, less than half the growth recorded in the previous marketing year.

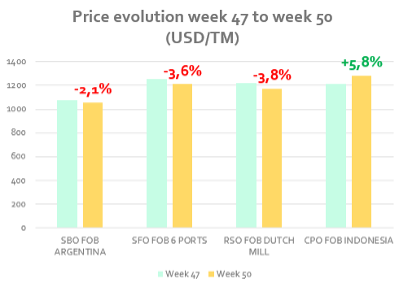

The graph below shows the price evolution of the 4 main oils in the last few weeks, highlighting the rise in palm oil, contrary to the evolution of the rest of the oils:

Palm oil prices remain at an unusually high premium to soybean, rapeseed and sunflower oils. CPO futures have even reached a new high recently. In addition, torrential rains in parts of Malaysia are expected to affect December production, exacerbating already tight supply problems.

Meanwhile, sunflower oil prices have recently declined for the first time since the start of the new season, as demand has stagnated and sunflower seed crushing has exceeded expectations in Russia. In Ukraine, yields are 9% below the 5-year average and seed production has been further revised downwards to below 12.5 MnT (USDA data), i.e. 15% less than in the previous season, although some local media are talking about a crop below 11 MnT.

At the same time, the EU has once again revised down production for this season, mainly in France, Romania and Bulgaria. As a result, world production of sunflower oil for the 24/25 season is estimated at 19.6 MnT, which represents a very significant drop of more than 15% vs. the 23.2 MnT of 2023/24.

In the case of the lauric oils, supply is tightening. Coconut oil has distantly followed the price leadership of palm kernel oil over the last 2 months and prices are expected to return to above PKO prices. Prices have risen by 15% CIF Rotterdam in the last 2 months as a significant decline in Philippine production is expected in 2025.

In palm kernel oil (CPKO), world production is expected to decrease, which will also lead to a decrease in exports. As a consequence, CIF Rotterdam PKO prices have doubled in 12 months.

For first-hand information on these and other aspects of the vegetable oil market, we invite you to download and read the LIPSA Market Report by clicking on the button above, where we cover the following points:

1. Vegetable oils

2. Palm Oil Market (CPO)

3. Soybean oil market (SBO)

4. Sunflower seed oil market (SFO)

5. Rapeseed oil market (RSO)

6. Lauric oils market (palm kernel and coconut)

7. Conclusions