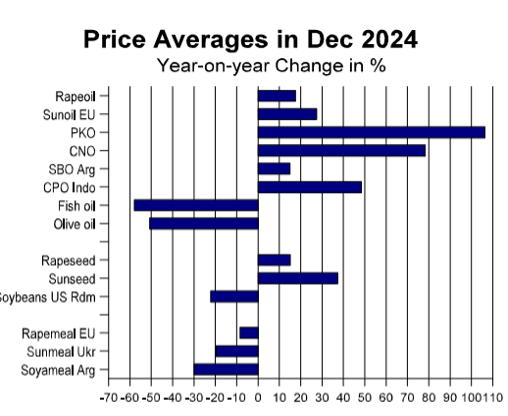

In 2024, vegetable oil prices have risen very significantly, especially lauric oils. Sunflower and rapeseed prices have appreciated by 28% and 18%, respectively, mainly due to the decrease in supply. In fact, world production of sunflower seed and rapeseed is estimated to decline by 5 MnT and 4 MnT respectively in the 2024/25 season.

On the other hand, Indonesian crude palm oil prices appreciated by 48%. The upward effect of lower production was coupled with increased consumption in Indonesia for biodiesel. It has also contributed to the rise in prices:

· The low rate of oil palm replanting.

· The ageing of trees and their declining yields.

· The decline in area in Malaysia.

Lauric oils, palm kernel and coconut, have been the most upwardly mobile, due to a drop in production in both.

Palm oil prices have recently declined against other vegetable oils. Still, CPO remains far from its historical competitiveness against other vegetable oils. On average between August/December 2024, Indonesian CPO had a premium of 110 USD/tonne over Argentine soybean oil, when over the last 10 years it had traded at an average discount to SBO of 100 USD/tonne.

The speed at which the new B40 biodiesel mandate is implemented in Indonesia remains a key factor to consider for short/medium-term palm oil prices.

Trade in sunflower oil has exceeded expectations so far this season. Crushing of seeds has been high in Russia and Ukraine, bringing exports of both to the same record level as last year during the fourth quarter of 2024. However, the severe decline in world sunflower production will inevitably result in demand rationing in the coming months.

Russian exports could remain high over the coming weeks, but Ukrainian exports are starting to decline. World sunflower oil exports are expected to decline by almost 2 MnT in the January/August 2025 period compared to last year, contributing to increased reliance on palm oil.

In the case of laurics, coconut oil regained a premium over palm kernel oil (CPKO) in the last days of the year after being at a discount vs. CPKO for more than 8 weeks. In the fourth quarter of 2024, supply shortages persisted, with limited availability of exports from the Philippines, mainly due to extreme rains in the main producing areas.

In palm kernel, stocks in Malaysia in December plunged to a 30-month low (-8.4% vs. November and -43% vs. a year earlier) after production fell sharply and exports were flat. Malaysia’s exports rose 17% in 2024, reducing stocks to the lowest level in almost 3 years in early January. Production is likely to be low in January due to lower seasonal production and continued rains affecting the harvesting process and yield.

For first-hand information on these and other aspects of the vegetable oil market, we invite you to download and read the LIPSA Market Report by clicking on the button above, where we cover the following points:

1. Vegetable oils

2. Palm Oil Market (CPO)

3. Soybean oil market (SBO)

4. Sunflower seed oil market (SFO)

5. Rapeseed oil market (RSO)

6. Lauric oils market (palm kernel and coconut)

7. Conclusions