In the current 23/24 season, stocks are expected to be lower than in previous seasons, which should support vegetable oil prices in the coming months, until the new season enters the market.

Export supply of sunflower will be limited between June and September, due to low stocks of sunflower seed.

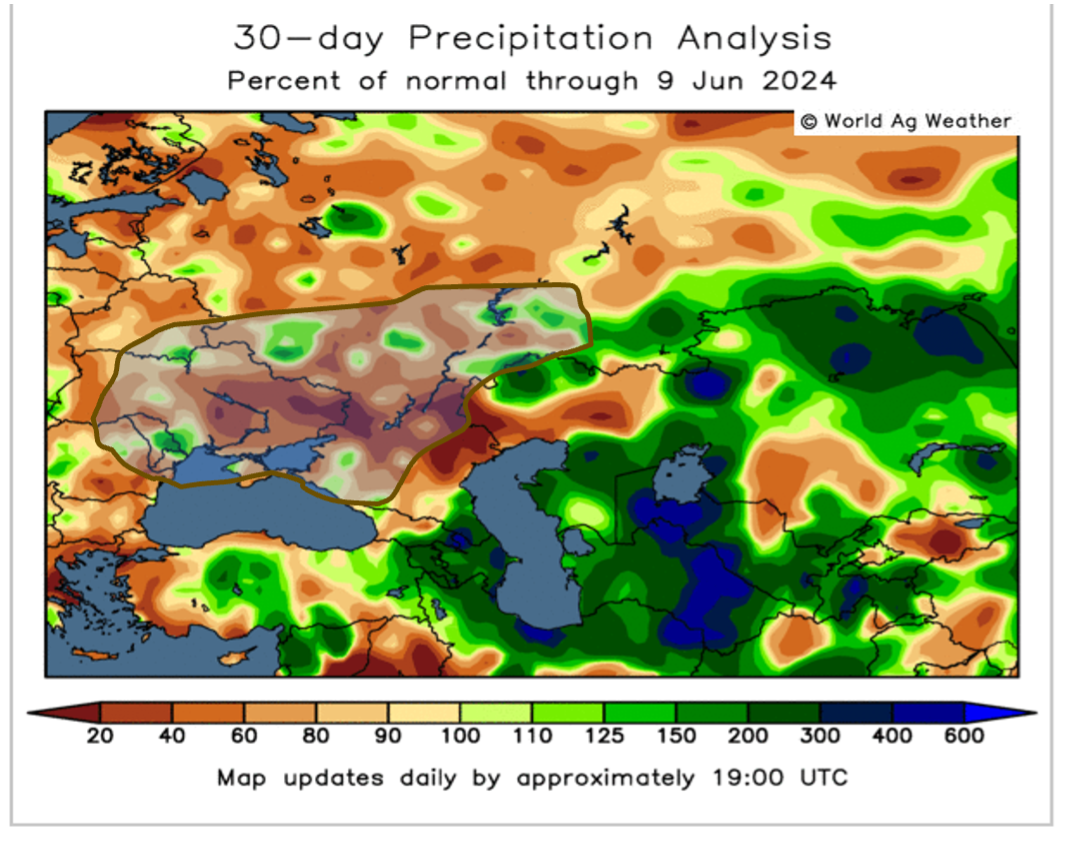

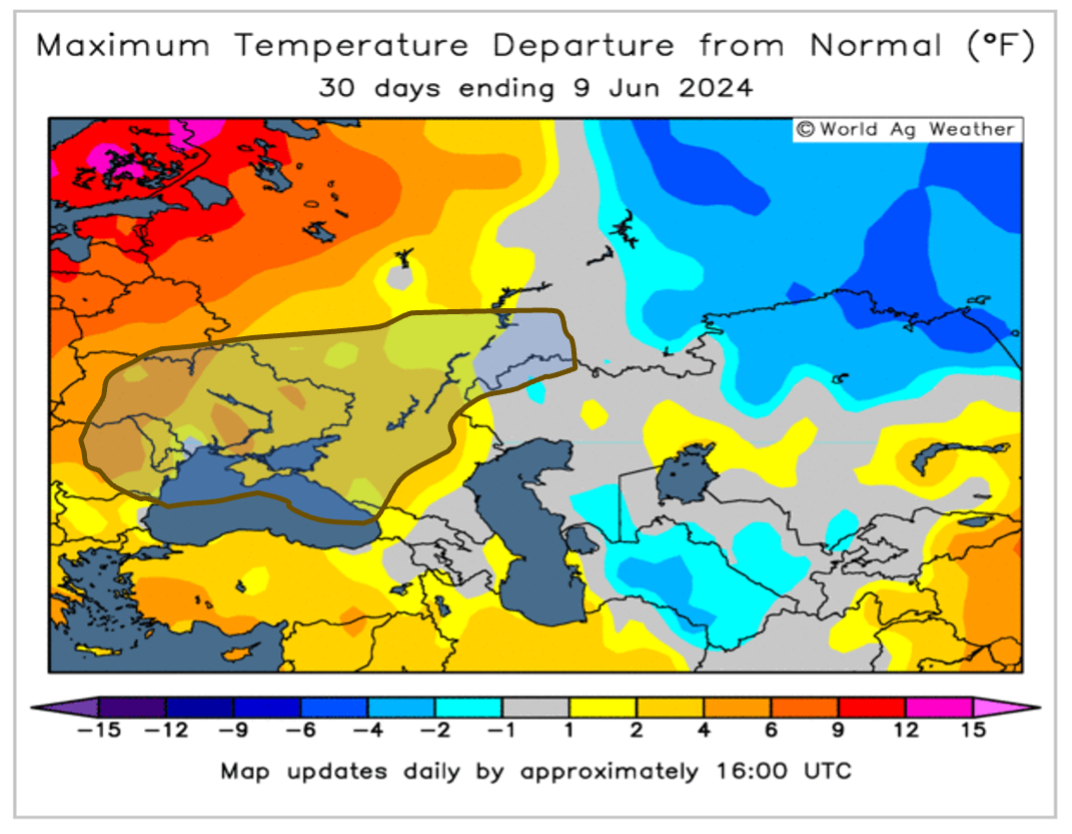

Well below normal rainfall and above normal temperatures have led to critically low soil moisture records, putting agricultural crops at risk in many parts of Russia and Ukraine.

Urgent rains are needed in Russia and Ukraine to ensure good yields in sunflower crops. Even assuming favourable weather, supply & demand for sunflower seed (and sunflower oil) will be under stress in the 2024/25 season.

Palm oil has improved its competitive position and is now offered at price discounts vs. other oils. Some fall in the availability of sunflower and rapeseed, coupled with the expected increase in demand for vegetable oil imports in the coming months, should improve demand for palm oil and support prices.

The rapeseed oil market will have to balance a potentially positive S&D in Canada by 2024/25 with a tight situation in major exporting countries such as Australia, Ukraine and the EU-27. The European rapeseed market in 2024/25 is expected to be heavily dependent on imports.

On the other hand, the fundamentals of the soybean complex remain bearish. US weather and mandate developments are the main factors to watch out for.

As far as Lauric oils are concerned, palm kernel prices rose in Rotterdam last week, by between $35 and $40/tonne. The average differential between palm kernel and coconut widened further to $277/tonne, levels not seen since July 2022. Raw coconut prices have continued to rise, to a one-month high and at a level almost 30% higher than in the same period last year. Sustained demand and limited supply are supporting prices. In parallel, the Philippines has received below normal rainfall in recent weeks which could affect production. Even with this scenario, coconut exports from the Philippines are forecast to recover by 10% in 2024 compared to 2023, which could partly grow by a shift from palm kernel to coconut in certain applications, as the latter is not affected by the EU deforestation regulation (EUDR).

For first-hand information on these and other aspects of the vegetable oil market, we invite you to download and read the LIPSA Market Report by clicking the button above, which covers the following points:

1. Vegetable oil prices

2. Sunflower oil (SFO)

3. Rapeseed oil (RSO)

4. Palm oil (CPO)

5. Soybean oil (SBO)

6. Lauric oils: coconut and palm kernel oil (palm kernel)

7. Conclusions