Vegetable oil prices have appreciated this month, while the palm oil situation is tightening with lower stocks, mainly in Indonesia, Malaysia and India.

The downward pressure on sunflower prices has faded as some slowdown in the level of crushing is expected in the coming months. As a result, prices have risen in recent weeks by almost 5% compared to the beginning of February. In addition, soybean oil prices have appreciated after touching the lowest level in several months. In fact, farmers’ sales are slowing down while US demand is accelerating.

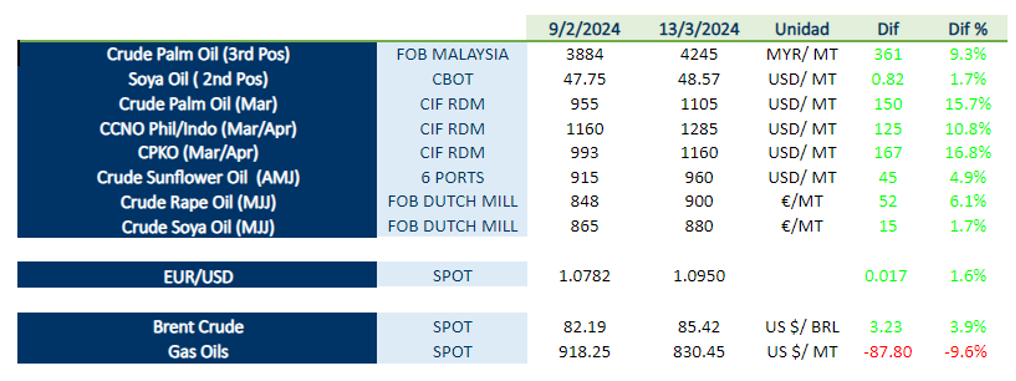

The attached table shows the change in prices of the main oils and other relevant factors over the last month:

The global vegetable oil stock is set to decline in 2024 and April, May and June are expected to be the tightest months for the palm oil balance. Some market factors currently are:

◘ Slowing production growth, particularly for palm, which is expected to remain broadly unchanged. Increased dependence on soybean oil. Expected increase in demand for oils, both for feed and biofuels.

◘ Uncertainty in several countries, especially regarding the Chinese economy and the extent of the crisis in maritime traffic through the Red Sea.

◘ Sunflower seed and rapeseed milling expected to slow down.

◘ Possible production shortfall in January/September 2024 may push up vegetable oil prices.

For first-hand information on these and other aspects of the vegetable oil market, we invite you to download and read the LIPSA Market Report, which you can download by clicking on the button above, in which we discuss the following points:

1. Vegetable oil prices in Europe

2. Vegetable oils: Q2 situation and stocks in Asia

3. Palm oil (CPO)

4. Sunflower oil (SFO)

5. Soybean oil (SBO)

6. Rapeseed oil (RSO)

7. Key factors to watch