These were the most relevant points made by two of the most renowned experts in the vegetable oil sector during the Price Outlook Conference (POC) 2025, held in Kuala Lumpur a few weeks ago:

Dorab E Mistry, Director of Godrej International

• CPO: production needs to be increased and it can and must be done in a sustainable way.

• There will be greater availability of CPO from April onwards.

• Political uncertainty can have a big impact on vegetable oil prices.

• Soybean production is expanding worldwide.

• Sunflower oil will most likely regain its position as a premium seed oil.

Thomas Mielke, Director of Oil World

• There is a shortfall in the production of vegetable oils in 2024/2025.

• Challenge for the coming years: to produce sufficient quantities of vegetable oils in a sustainable way.

• Price volatility has increased.

• There are major challenges in the CPO market: lack of replanting, increasing area of mature palm, rising costs, tree disease, etc.

• Biodiesel production could be lower than expected in 2025.

• Downside potential for CPO when production increases seasonally.

• Sunflower oil: bullish outlook and will lead seed oil prices.

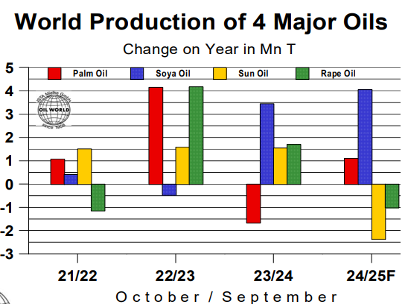

This season, the drop in sunflower and rapeseed oil production will be the biggest in many years. Below is a comparison of the 4 vegetable oils with the highest production in recent years:

Palm oil continues to lead prices, still supported by production problems in Malaysia and Indonesia. However, some downward pressure could occur if exports from Malaysia and Indonesia increase due to higher seasonal production from April onwards. In addition, current weak demand is likely to contribute to price adjustment in the short to medium term. Indeed, some consumers continue to shift part of their demand to soybean oil.

On the other hand, sunflower crushing has declined sharply since December in Ukraine and the EU and since last month in Russia. In the last quarter 2024, Russian SFO exports were up 23% y-o-y to 1.35 MnT, even despite a smaller crop. This explains the sharp drop in Russian exports that has already started and will most likely continue to decline through September. In Ukraine, the decline in crushing has accelerated in the last 3 months. For the current season, sunflower seed crushing is estimated to decline by 3 MnT in Ukraine.

It is expected that in the coming months, up to and including September, supply and demand for sunflower and especially for HOSO will be tight, given the limited availability until the new season. In this situation it is very likely that sunflower oil will become a premium oil. As for coconut oil, prices have risen sharply mainly due to supply shortages in the Philippines and Indonesia due to adverse weather conditions.

This oil usually commands a premium of between $100 and $200/ton over crude palm kernel oil, but the differential has increased to over $300/ton in recent weeks, reflecting supply problems. Higher prices have been reflected in a slowdown in exports.

In the case of palm kernel, local prices in Malaysia have recently recovered on the back of increased export demand and higher CPO and coconut prices.

For first-hand information on these and other aspects of the vegetable oil market, we invite you to download and read the LIPSA Market Report by clicking on the button above, where we cover the following points:

1. Vegetable oils

2. Palm Oil Market (CPO)

3. Soybean oil market (SBO)

4. Sunflower seed oil market (SFO)

5. Rapeseed oil market (RSO)

6. Lauric oils market (palm kernel and coconut)

7. Conclusions