In recent days we have seen a sharp fall in palm oil prices, driven by the expectation of a seasonal recovery in production, as well as by an adjustment in its prices after trading at a premium to other oils for several months. In parallel, there has been a significant rise in rapeseed oil prices, reaching multi-month highs, due to a tighter situation in Europe and a recovery of milling margins.

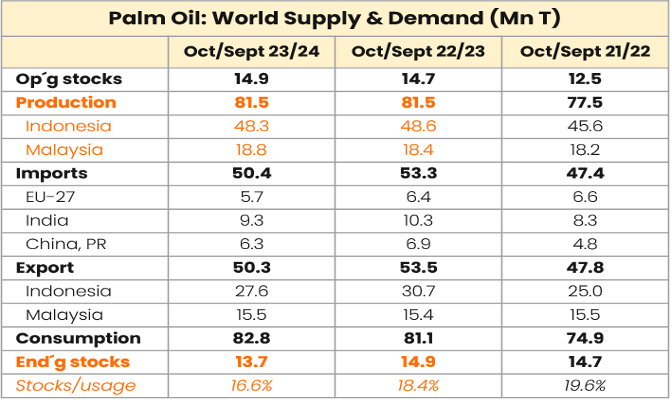

Sunflower oil prices fell less than palm and soybean prices due to expectations of a slowdown in crushing for the remainder of the season, while soybean prices were affected by the arrival of the South American harvest and a sharp drop in prices on the Chicago market. Palm oil production will remain unchanged this year, as shown in the table below, reaching the end of the season with a significantly tighter stock/use ratio than in previous seasons:

Palm oil stocks are rising after reaching the lowest level in several months during the first quarter of 2024. Oil World estimated stocks at 15.1 MnT at the end of December and 13.2 MnT at the end of March. Despite this recovery, world stocks are expected to reach a 3-year low of 13.7 MnT at the end of September this year. In parallel, the entry into force of the EU Deforestation Regulation (EUDR) will be a challenge for the European market.

As far as sunflower oil is concerned, production growth has already occurred in the first half of this season, with a 20% and 22% increase in Russia and Ukraine, respectively, compared to last year. This explains the price pressure we have seen and why sunflower has been cheaper than palm, soybean and rapeseed oils for several months. A slowdown in production and exports is expected for April/September.

Ukrainian sunflower seed stocks at the end of April will be 0.8 to 0.9 MnT below last year. Sunflower oil is likely to hold firm against other oils and develop price premiums over palm oil and SBO.

For a first-hand look at these and other aspects of the vegetable oil market, we invite you to download and read LIPSA’s market report by clicking on the button above, in which we discuss the following points:

1. Vegetable oil prices

2. Vegetable oils: supply and demand

3. Palm oil (CPO)

4. Soybean oil (SBO)

5. Sunflower oil (SFO)

6. Rapeseed oil (RSO)

7. Conclusions