Vegetable oil prices have strengthened over the past month. Despite significant losses in energy markets, uncertainty over palm and soybean oil production has led buyers to be very active. With the global oil balance likely to tighten in the coming months and the stocks-to-use ratio expected to decline, analysts anticipate a tighter supply of vegetable oils in the first half of 2024.

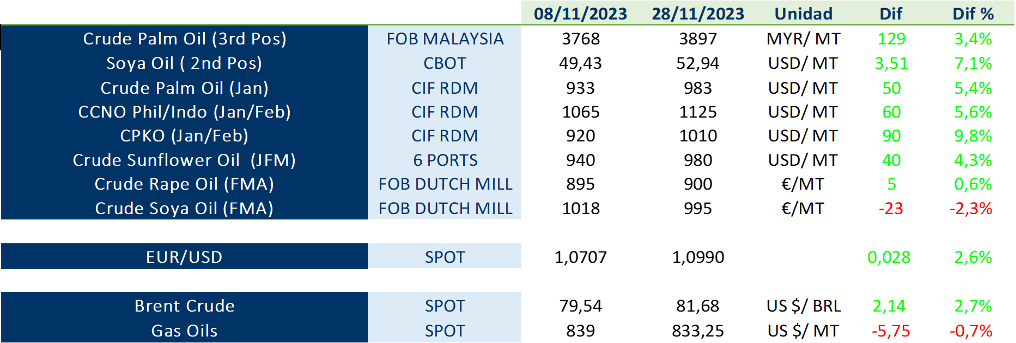

The following chart shows prices at the beginning and end of November:

Oil World estimates Indonesian palm oil production for October-September 2023/24 at 48.2 MnT, slightly lower than 2022/23 and presenting a slowdown scenario. Malaysian palm oil production is expected to increase from the previous year in October/December 2023 and also remain above the previous year’s level in January/June next year. Global palm oil supplies are sufficiently large, with Malaysia, India and Pakistan, as well as some other importing countries, standing out.

Regarding the El Niño weather phenomenon, it should be noted that it has caused below-average rainfall in several regions of Sumatra and Kalimantan since August, resulting in a decline in palm oil production. Since most forecasts indicate that El Niño is likely to persist until May or even June 2024, monitoring actual rainfall and assessing whether oil palms will experience stress are crucial variables.

Excellent soybean harvests in Argentina are offsetting soybean production losses in Brazil and leading vegetable oil market prices higher in recent weeks. Sunflower oil prices have risen in line with world market developments. Rapeseed oil prices are supported by rising soybean oil and palm oil prices in Rotterdam.