During the last few weeks, the price of palm oil has risen sharply, driven by unusually low production and higher domestic consumption in Indonesia, which has reduced stocks at the end of the month in both Malaysia and Indonesia.

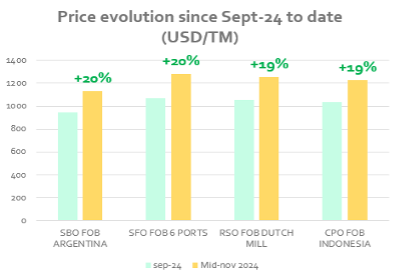

The graph below shows the price evolution of the 4 main oils in the last two months in their respective reference markets:

Indonesian CPO exports will end 2024 at their lowest level in several years. In addition, there is uncertainty about the prospects for the biodiesel blend: the B40 mandate is scheduled to come into force in January 2025, but the new president is now talking about B50. For the time being, no decision has been taken.

On the positive side, production is expected to pick up in Indonesia next year thanks to favourable weather and improved yields. Oil World estimates that production will reach 48.2 MnT in 2025 (vs. 46 MnT in 2024).

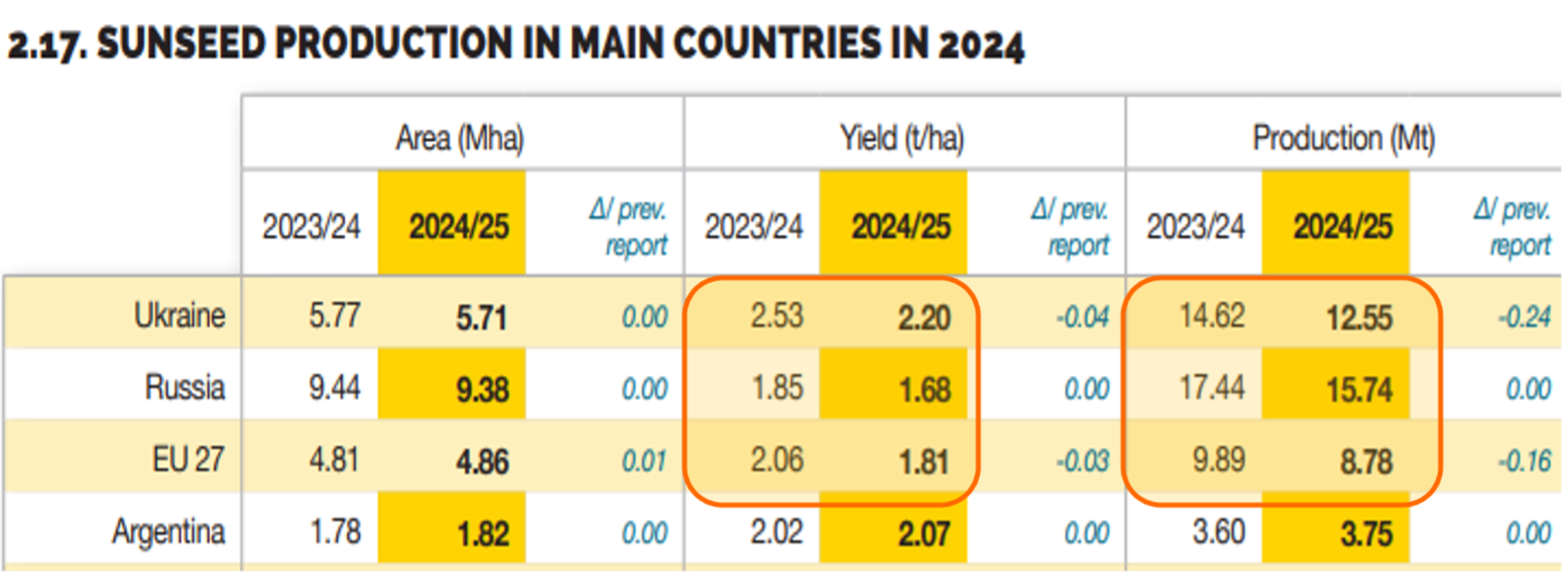

In sunflower, in line with further downward revisions in seed production, global sunflower oil supplies will inevitably shrink. Seed production is forecast to fall by more than 4 MnT (equivalent to 1.6 MnT of oil). The table below shows the fall in the main producing regions, which is very relevant considering that Ukraine and Russia together account for more than 70% of the volume exported globally.

In this context, prices are likely to remain high and may even continue to rise. However, consumers will be forced to turn to other oils, in a context in which palm oil production remains below its potential, rapeseed supplies are scarce and soybean oil supplies cannot compensate for all the losses of rival oils.

Special attention should also be paid to high oleic sunflower, also with a very significant drop in production in the main producing countries, which could compromise its availability especially towards the end of the season (July to October 2025). This has already led to a large increase in its premium compared to conventional sunflower.

In the case of the lauric oils, coconut and palm kernel, their markets are facing supply challenges, which has led to very significant increases in their prices. Coconut oil normally trades at a premium due to its better oleochemical properties, but recent price increases for palm kernel oil have reversed this trend. Coconut prices have risen 86% since the beginning of 2024, driven by supply shortages and disruptions in the Philippines following Typhoon Man-yi.

Palm kernel oil prices have recently reached their highest level since May 2022, supported by supply shortages, strength in crude palm oil futures and the additional cost of complying with sustainability regulations. Crude palm kernel oil has traded at a premium of up to $100 over coconut oil, when historically it has typically traded at a discount.

For first-hand information on these and other aspects of the vegetable oil market, we invite you to download and read the LIPSA Market Report by clicking on the button above, where we cover the following points:

1. Vegetable oils

2. EUDR implementation

3. Palm Oil Market (CPO)

4. Soybean oil market (SBO)

5. Sunflower seed oil market (SFO)

6. Rapeseed oil market (RSO)

7. Lauric oils market (palm kernel and coconut)

8. Conclusions