During the last three weeks, the weather situation has remained unchanged. The weather in the United States has been very favourable for soybean crops. However, unfavourable conditions continue to affect canola crops in Canada and sunflower in the Black Sea region.

Sunflower has suffered from an intense heat wave and lack of rainfall in Russia, Ukraine and Eastern Europe. There is already irreversible damage in these areas, which are the main producing region in the world, accounting for almost 70% of world production. The situation is serious and the final pre-harvest weather is expected to bring very high temperatures and no rainfall, which would not only continue to affect yields but also the oil content of the sunflower seed.

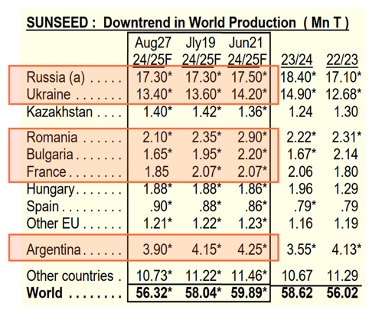

In the last two months, at least 3.6 MnT of sunflower seeds have been lost due to adverse weather in the Black Sea region, Russia and France. The table below shows the crop forecast for the new season 24/25 and the evolution of the estimates since the end of June:

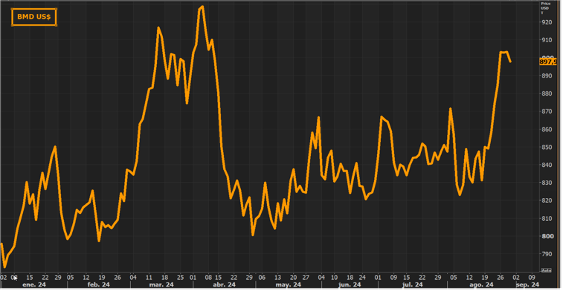

In the case of palm oil, Indonesia aims to implement a mandatory 40% palm oil-based biodiesel blend by early next year, which would increase domestic consumption by approximately 3-4 MnT, according to APROBI, reaching a total of more than 13 MnT of palm oil for biofuel use.

In addition, optimism about palm export demand to India, with increased reliance on palm oil imports due to lower than expected sunflower and rapeseed oil supplies, along with reports of reduced Indonesian production due to dry weather and ageing trees have contributed to the price increase in recent days.

In the case of palm kernel oil, increased import demand, particularly from Europe and China, and declining stocks in producing countries have led to a significant appreciation of its price to over USD 1,500 in Rotterdam, reaching a two-year high.

Coconut oil prices have also risen due to increased global demand and concerns about slowing production and export supply. Oil World expects a sharp decline in production in the Philippines in 2025. In addition, the Philippine government plans to increase the biodiesel blend, based mainly on coconut, from 2% to 3% from October 2024.

For first-hand information on these and other aspects of the vegetable oil market, we invite you to download and read the LIPSA Market Report by clicking on the button above, where we cover the following points:

1. Vegetable oils

2. Palm oil market (CPO)

3. Soybean oil market (SBO)

4. Rapeseed oil market (RSO)

5. Sunflower oil market (SFO)

6. Lauric oils market (palm kernel and coconut)

7. Conclusions