Vegetable oil prices have continued to fall in recent weeks, although they seem to have found some support, especially for sunflower and rapeseed in recent days.

Palm stocks have declined in Indonesia and Malaysia over the last three months. As a result, the price of palm oil has appreciated relative to sunflower, rapeseed and soybean oils, causing demand from India and other importing countries to shift from palm oil to seed oils.

On the other hand, the euro continues to appreciate against the dollar. Oil prices have risen sharply following the OPEC+ announcement of a production cut from May onwards.

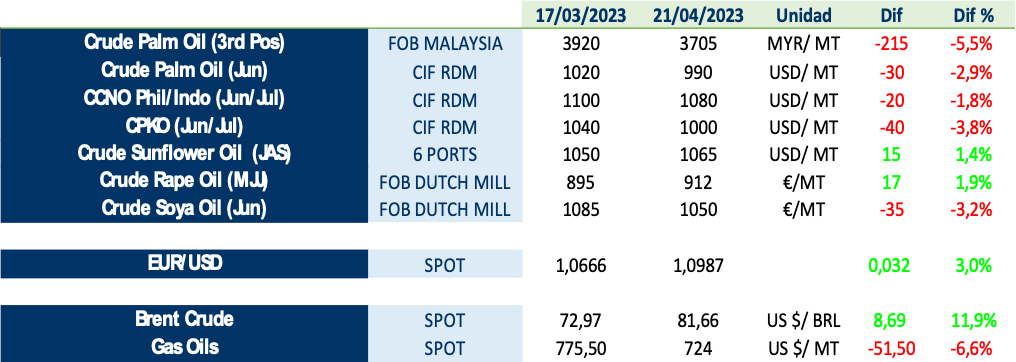

The table below shows the evolution of some oils and other relevant factors in the last month:

The strong pace of rapeseed crushing has pushed rapeseed oil prices below palm oil for the first time in 25 years. On the production side, the lack of winter rains in Saskatchewan, Canada’s main producing region, could result in a smaller crop next season. On the other hand, the El Niño weather phenomenon may pose a risk to Australian crops, although it is still too early to assess its impact.

In the case of sunflower oil, growing conditions in Europe are currently favourable, except in Spain, which is suffering from a severe drought. Some parts of Eastern Europe are also dry, but forecasts are favourable. Strong export supply pressure from Russia and Ukraine, coupled with ample supplies of sunflower oil and rapeseed oil in Europe, has put downward pressure on sunflower oil export prices. Farmers are active sellers to limit their exposure to possible losses. Producers in Ukraine are determined to maximise sales in the short term, while importers’ activity is very low.

In palm oil, stocks in Malaysia at the end of March have fallen much more than expected, by 21%, to a 9-month low, due to higher than expected exports (+32%) and a small improvement in production (+2.8%). Also in Indonesia, stocks fell in February to a near 4-year low, according to GAPKI: 14% lower vs. January close, and 47% lower compared to February 2022 levels.

CPO prices remain relatively firm due to several reasons:

• The rebound in energy prices.

• Seasonally low production in Southeast Asia.

• Some export restrictions in Indonesia.

• A sharp increase in Malaysian exports during March.

CPO prices are currently moving between the loss of market share, mainly to sunflower oil, on the one hand, and low stocks in Malaysia and Indonesia, on the other.

To learn more about the market situation, we invite you to download the LIPSA Market Report by clicking on the button above, in which we discuss the following points:

1. Vegetable oil markets

2. External: OPEC+ cuts oil production

3. Rapeseed Oil

4. Sunflower oil

5. Soybean oil

6. Palm oil