Vegetable oil prices have recovered in the last week, but a downward trend persists for soybean, rapeseed and sunflower. Demand has been weak, mainly in India and China, the world’s top two importers of oils and fats.

However, new potential risks have emerged in the Argentinean soybean crop, while final production in Brazil is still unclear. The situation in both the Red Sea and the Panama Canal should also be closely monitored.

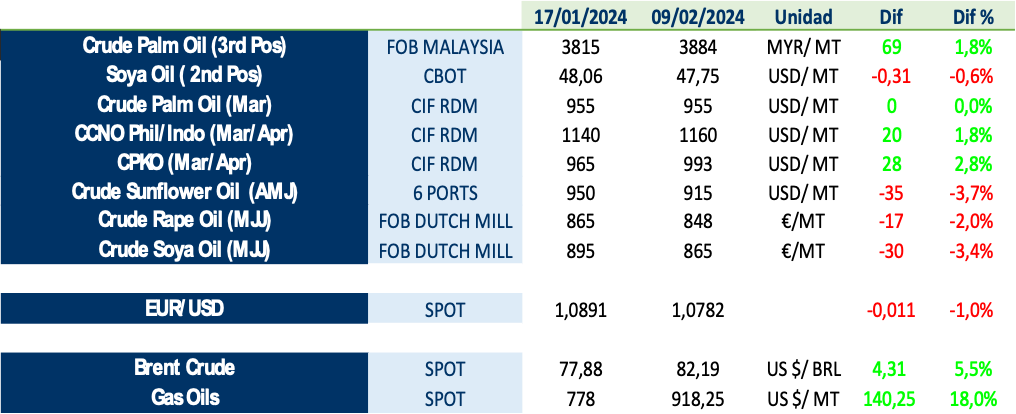

The attached graph shows the price variation of the main oils and other relevant factors, in the last 3 weeks:

Regarding palm oil, January production in Malaysia is expected to fall by around 10% versus December, the lowest level in 9 months and the third consecutive monthly decline. Month-end stocks could end at the lowest level in 5-6 months. Malaysia’s annual production is expected to be 18.75 MnT, which would mark the 4th consecutive year of production below the 5-year historical average.

Palm oil prices have recovered recently, supported by seasonally low production in Asia and declining stocks. The global palm oil balance in 2023/24 shows a deficit. However, many consumers, such as India, are expecting lower prices. In addition, more attractive sunflower prices have led to a partial substitution of palm oil consumption in some countries.

As far as sunflower oil is concerned, Strategie Grains (SG), indicates that the global situation in 2023/24 seems to be generally well balanced, with a Stock/Use ratio of 8.2%, in line with the average of the last five years. However, the situation varies from country to country: a surplus in Russia contrasts with an expected tight situation in the EU and Turkey, where imports of Ukrainian sunflower seed are expected to decline sharply due to customs restrictions imposed by importing countries. In Ukraine, the market expects to enter the new season in October with very low stocks.

Finally, in lauric oils in Rotterdam, the average differential between coconut and palm kernel is slightly higher than in the previous week. The price of coconut in Rotterdam has risen by around USD 60/tonne since the beginning of the year. World production is likely to remain behind the level of a year ago, mainly because of the current yield decline in the Philippines. However, the Philippine government launched in October 2023 an ambitious replanting plan of 100 million coconut trees until 2028, which would represent the largest replanting initiative in many years. On the other hand, global coconut exports are expected to fall to a 3-year low in the October/September 2023/24 season, so demand for palm kernel could increase.

We invite you to download the LIPSA Market Report on the button above, in which we discuss the following points:

1. Vegetable oil prices

2. Soybean oil (SBO)

3. Palm oil (CPO)

4. Sunflower seed oil (SFO)

5. Rapeseed oil (RSO)

6. Lauric oils (coconut and palm kernel)