The sunflower harvest is almost over, with yields and qualities lower than in previous years in most countries. Farmers in the Black Sea area have reported very low yields due to the prolonged drought in recent months. The overall harvest in 2023/2024 was 58.8 MnT vs. the 53.7 MnT forecast for the 2024/2025 season, although this forecast may end up being lower.

This has resulted in higher sunflower prices, especially for high oleic sunflower, whose crop is particularly poor and, moreover, in some cases the oleic fatty acid content of the oil extracted does not meet the minimum stipulated to be considered high oleic.

Milling of rapeseed oil is currently going very well, with record levels. But this rate is not expected to be sustained over time, as the current crop will be lower than last year’s: a decrease of about 3 MnT is estimated.

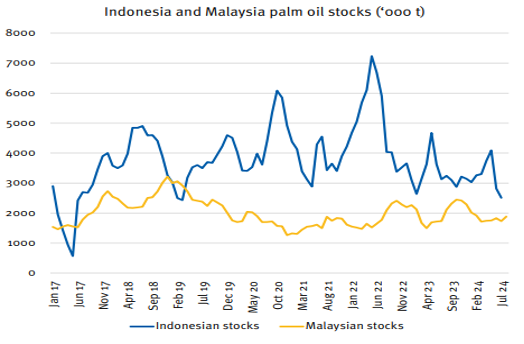

Palm oil is experiencing price rises due to non-growing production and the support provided by poor sunflower and rapeseed harvests. In addition, consumption of palm oil for biodiesel is currently increasing in several countries, the most significant being Indonesia, which plans to move from B35 to B40 shortly.

In addition, palm stocks in Malaysia and Indonesia are relatively low, as shown in the graph below:

Soybeans, in contrast to the aforementioned oils, have excellent crop and yield forecasts in the US. In addition, it should be noted that the initial stocks of soybeans are the highest in the last 4 years.

Soybean planting has been delayed in Brazil awaiting optimal planting conditions. These seem to be arriving with light rains during the last few weeks, so planting is expected to start soon.

On the other hand, lauric oils have not had much news this month. Palm kernel is awaiting news from the EUDR, which generates some uncertainty and volatility in the market.

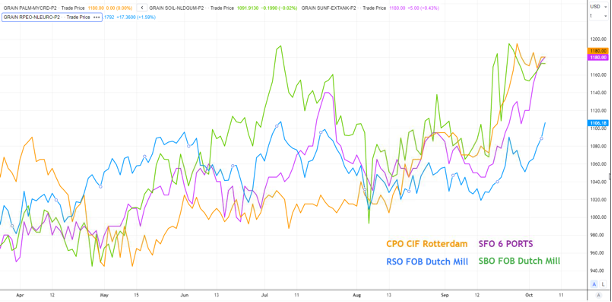

In the graph below, we can see the upward trend of the main oils due to the above mentioned events. The trend is not expected to change drastically in the short term.

For first-hand information on these and other aspects of the vegetable oil market, we invite you to download and read the LIPSA Market Report by clicking on the button above, where we cover the following points:

1. Vegetable oils

2. Palm oil market (CPO)

3. Soybean oil market (SBO)

4. Sunflower oil market (SFO)

5. Rapeseed oil market (RSO)

6. Conclusions